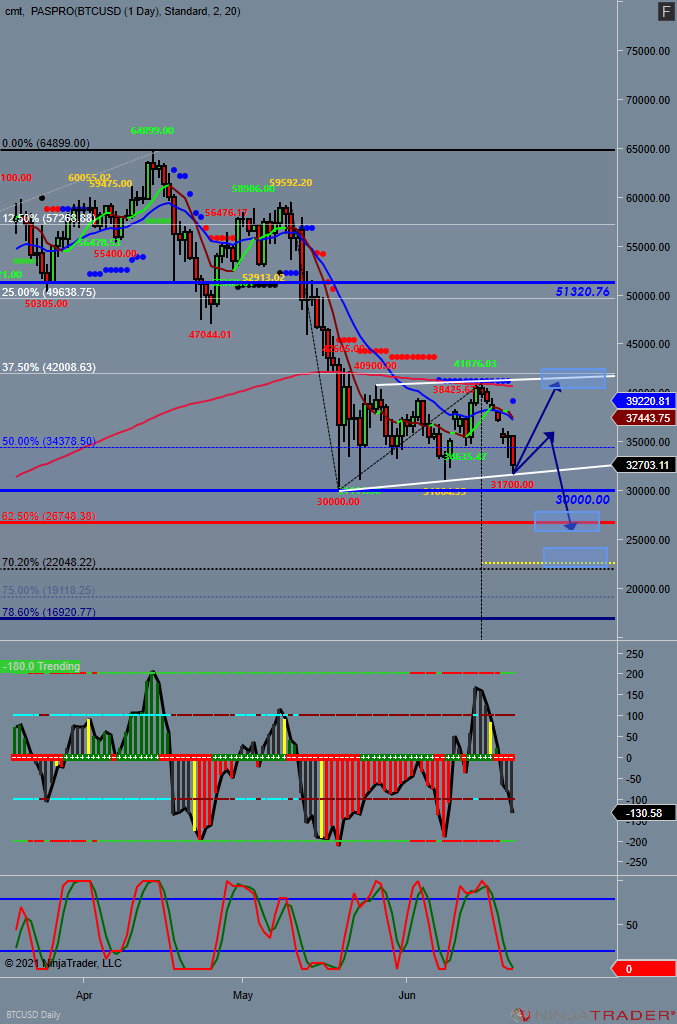

Bitcoin in consolidation, clearing TL and 30000 swing low could push to next target 26750 followed by 22600 zone.keep in mind momentum oversold. if 31000-32000 TL holds we could test upper trend line at 41000 again.

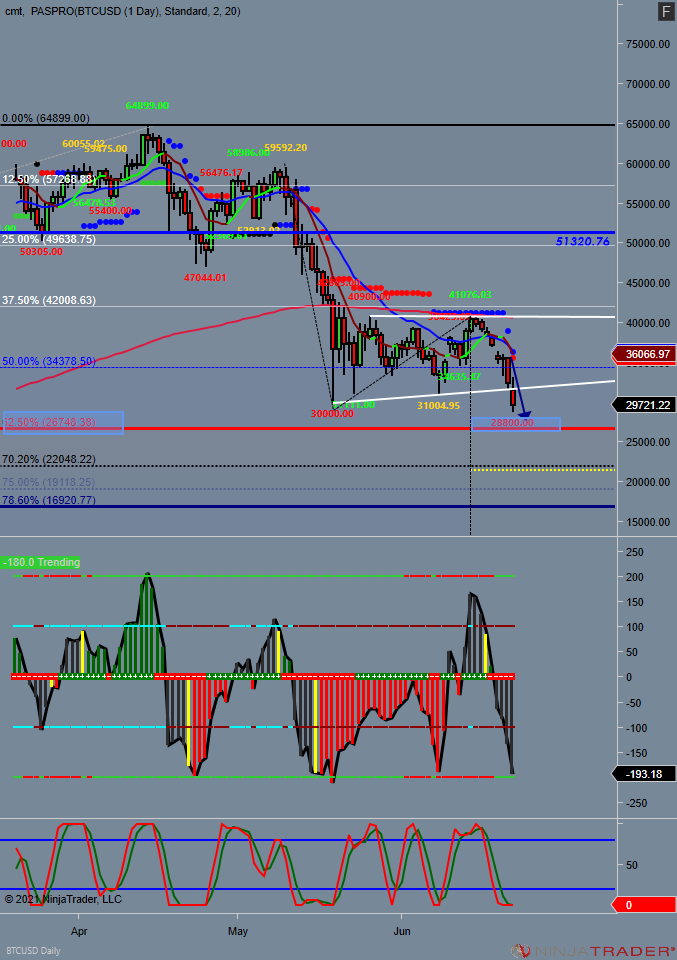

#Bitcoin $BTCUSD took out TL & 30000 swing support heading towards initial target 27500 -26750 (62.5%) watch 25K followed by 21-22K zone if we slice through 25K. LOD so far at $28800

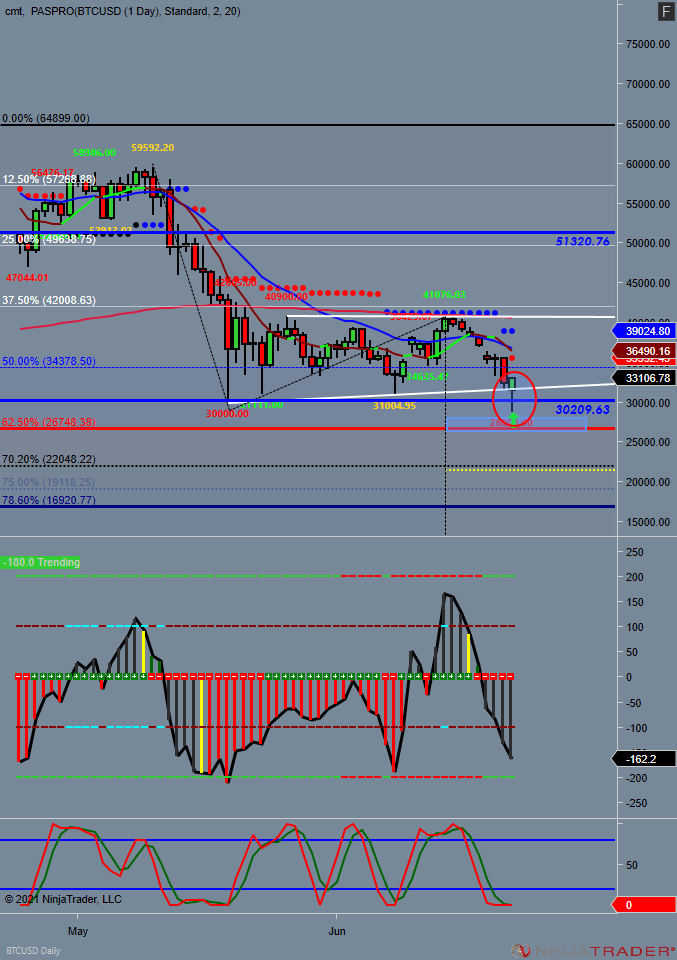

#bitcoin A fast Intra-day reversal indicating a potential Spring reversal long setup on $BTCUSD after new low at $28800 into wave 5 target zone was archived above 62.% support zone. if this low holds we can rally back to 41000 if cleared possible 50K zone in the coming days/weeks

Leave a Reply