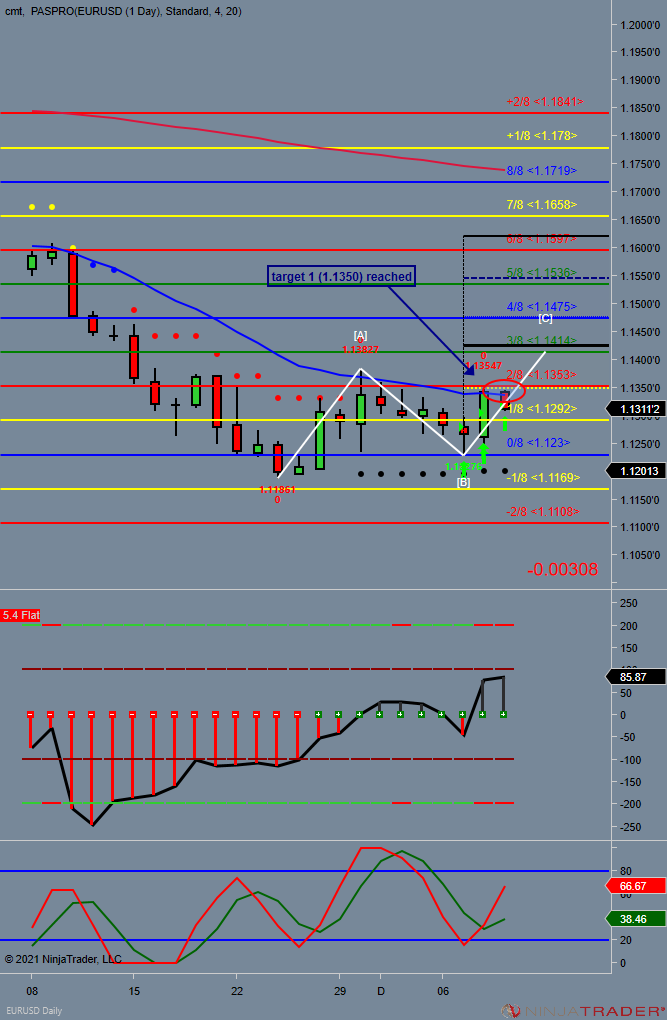

Long setup Triggered

Initial Target Reached 1.1350

pulled back off resistance target

as anticipated

Scratched teh trade as momentum reversed and Re-entered again after report and momentum resumed on Firday Dec 10 2021

scratched the trade

240min Chart held support

30 min chart entry trigger

Leave a Reply