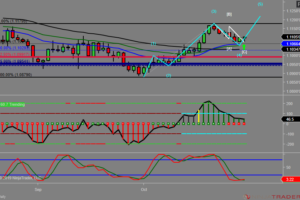

Weekly chart over sold for possible reversal, been watching that pullback on bonds to go long the pst week.

Waited for confirmation based on Daily HL above 157’03 weekly low, at 157’07 and retest of double bottom at 240 min last night, confirmed the bottom reversal, went long at a pull back early this morning at 157’18 for a swing setup. initial stop below LOD at 157’07.stoped moved right away to 157’15 once the move confirmed as we took out yesterdays high at 158’05. and trailed it higher on intraday below swing lows and exited at target 158.16 prior swing high rejection. Will wait for a pullback to re-enter as market cleared 158.16 after a strong pullback(didn’t get long as I was away from computer ) managed to exit at 158’13 for R:R=1:2.25 actual trade results MAE -3 tics MFE=30 for R:R=1:10 10R

still looking for a bigger move towards 159-160

October 27 update 160’10 swing high target was reached

Leave a Reply