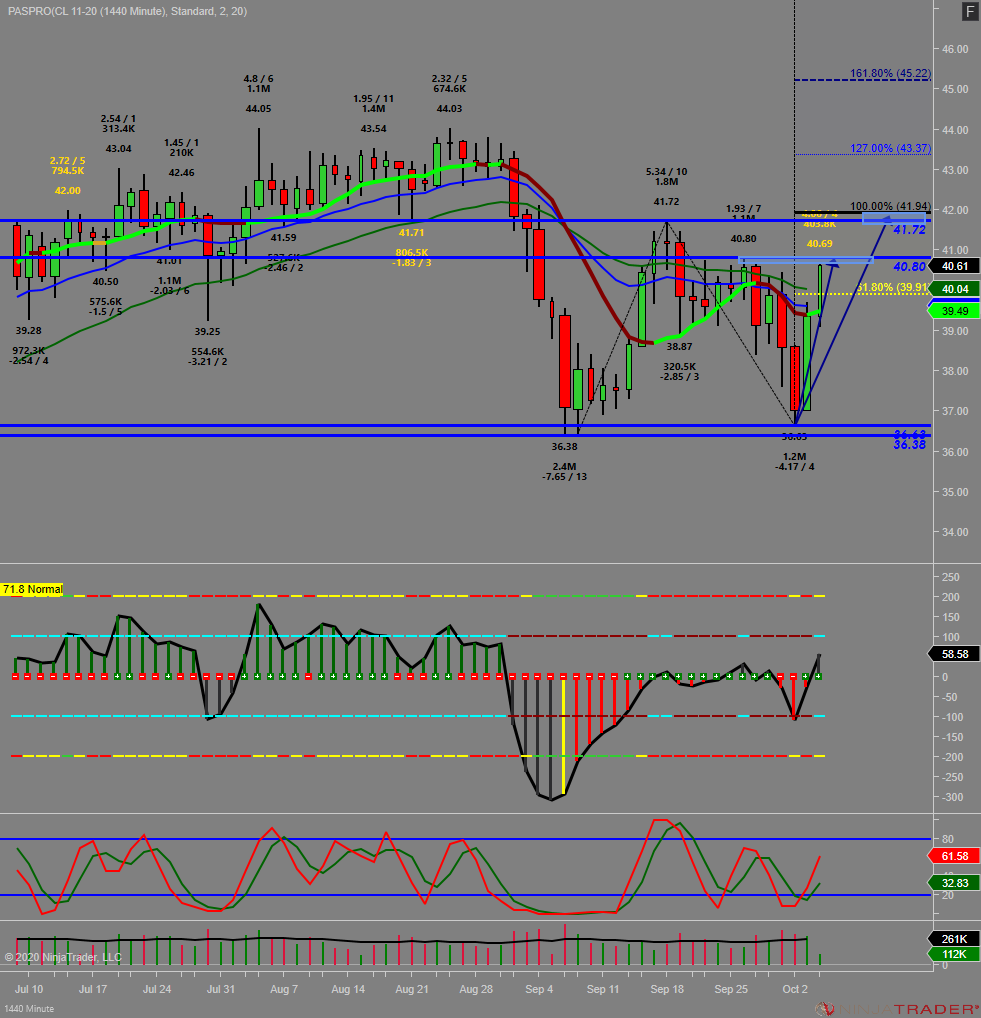

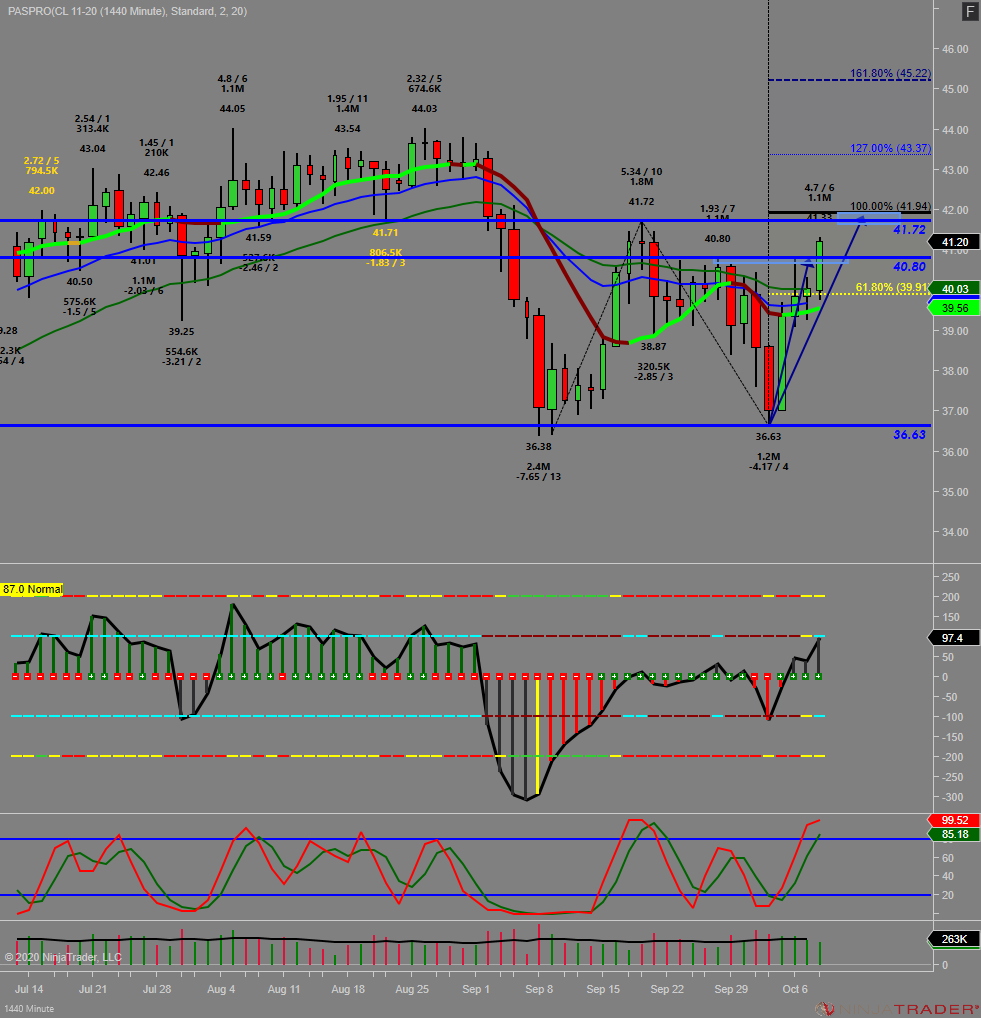

VT trigged on daily chart for initial target T1 40.80 Followed by T2 41.72-42

#CL_F heading to 40.80 zone swing high target T1 followed by 41.72-42 protected T2 zone #daytrading #trading $crude #futures #crude #ES_F pic.twitter.com/PZQHBuCLe9

— Gus Joury (@Gussj) October 6, 2020

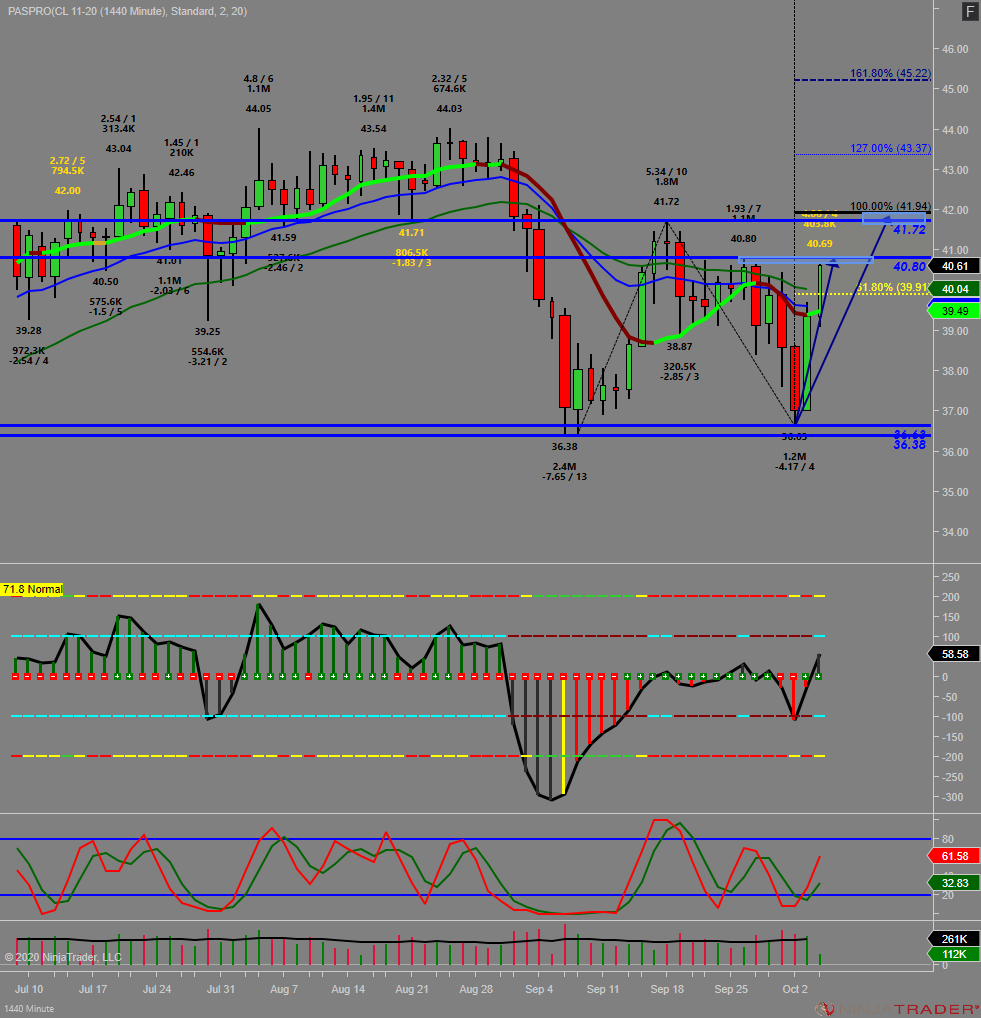

WE hit out target T1 40.80 and pulled back form that level so far #trading #futures #CL_F #crude #daytrading #ES_F pic.twitter.com/Ntp2AaNpD4

— Gus Joury (@Gussj) October 6, 2020

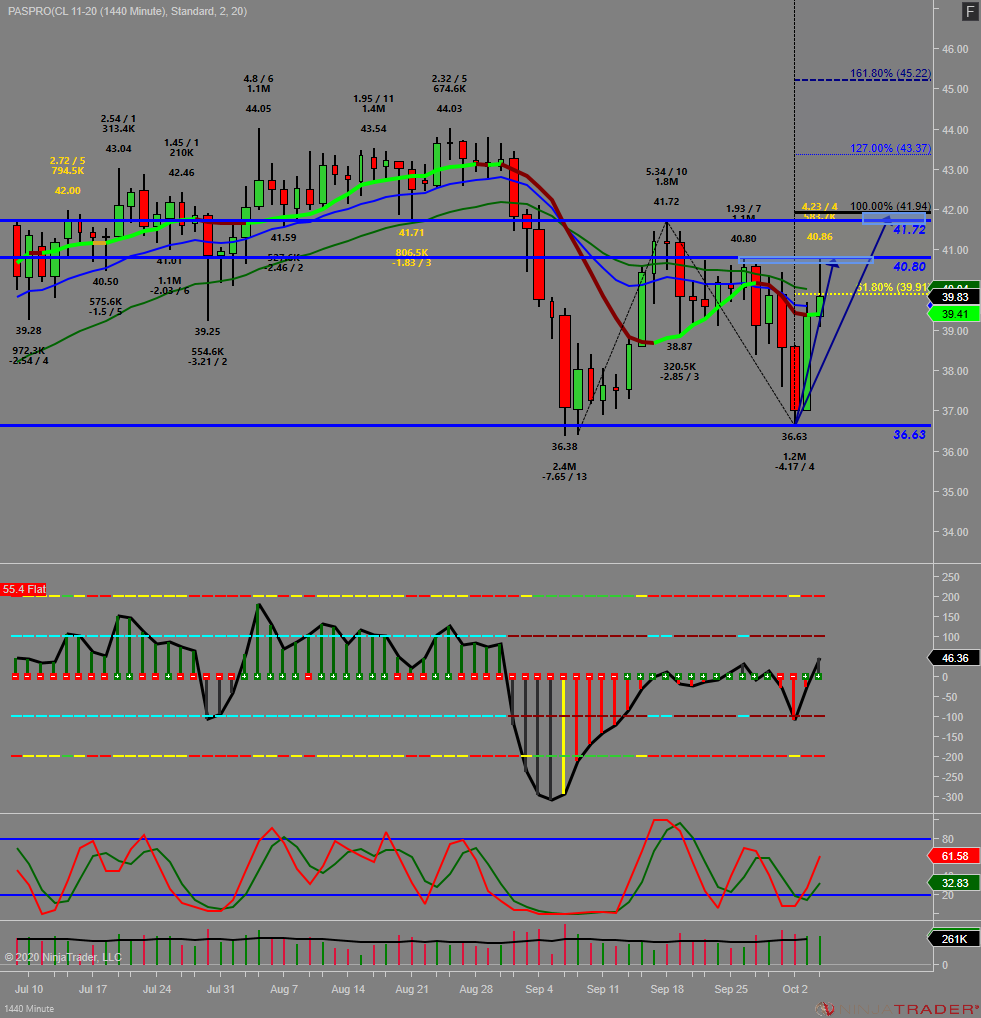

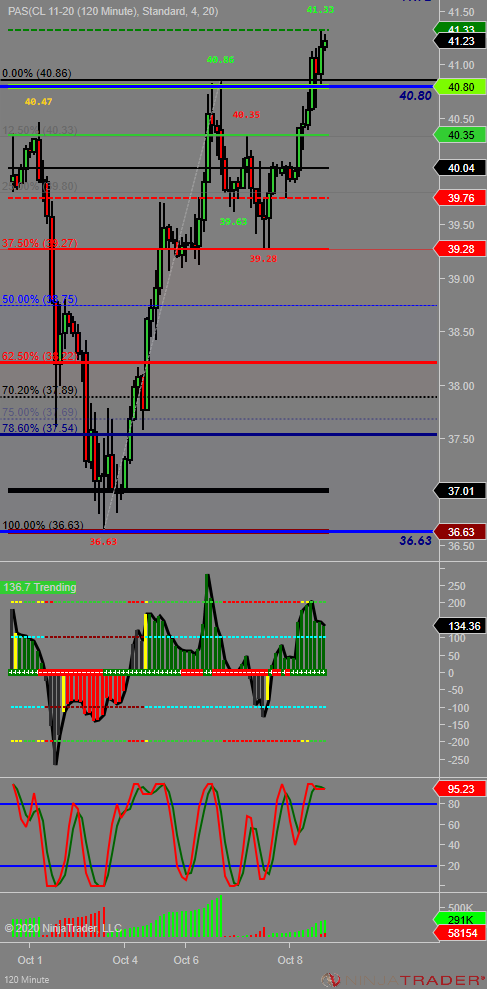

#CL_F Breaking higher towards T2 41.72-42 following a 37.5% pullback #trading #crude $oil #Futures pic.twitter.com/84m2FHRdcx

— Gus Joury (@Gussj) October 8, 2020

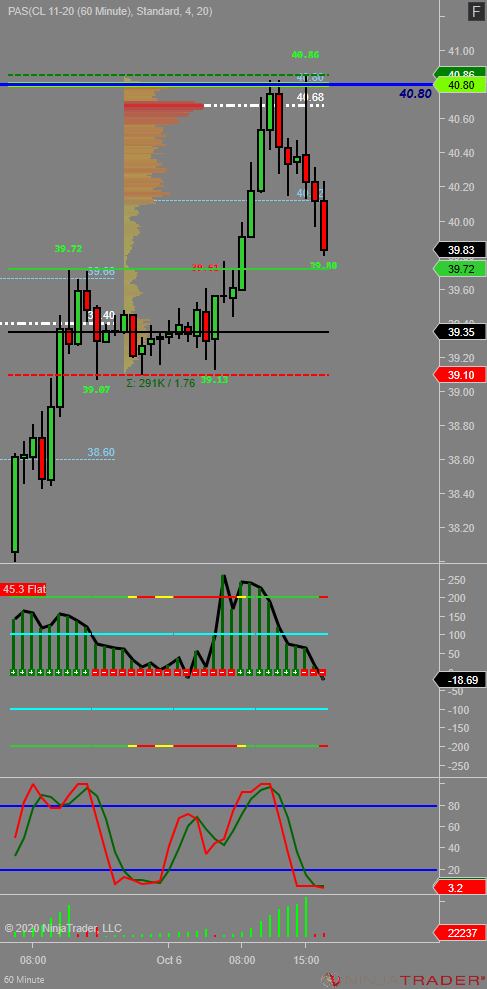

#CL_F Bouncing off prior T1 resistance 40.80 (acting as support ) for continuation towards T2 41.72-42 zone #crude #futures #daytrading $oil $wti #swing #trading pic.twitter.com/cXRiSIu8TJ

— Gus Joury (@Gussj) October 9, 2020

Leave a Reply