Feb 10 2021

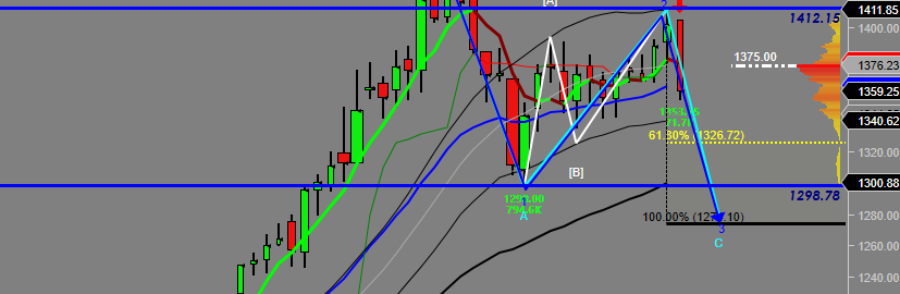

Soy Beans Futures ZS_F triggering a sell single earlier today when it clear yesterdays Low 1377 (entry) after a messy corrective ABC up move towards 1412 which also happens to be 78.6% Fib retracement from High (1436.5-1298).

looking for targets 1340-35 followed by 1325 ,1300 and possible symmetrical move towards 1275.

Stops should remain above yesterdays high or trailing them closer based on individuals risk and money Management rules.

Let’s see how this setup materialize in the next few days.

Good luck

Feb 11 2021

Market reached initial Target zone mentioned yesterday over night at 1337.25 taking out this low could push towards next target 1326 followed by 1300

Leave a Reply