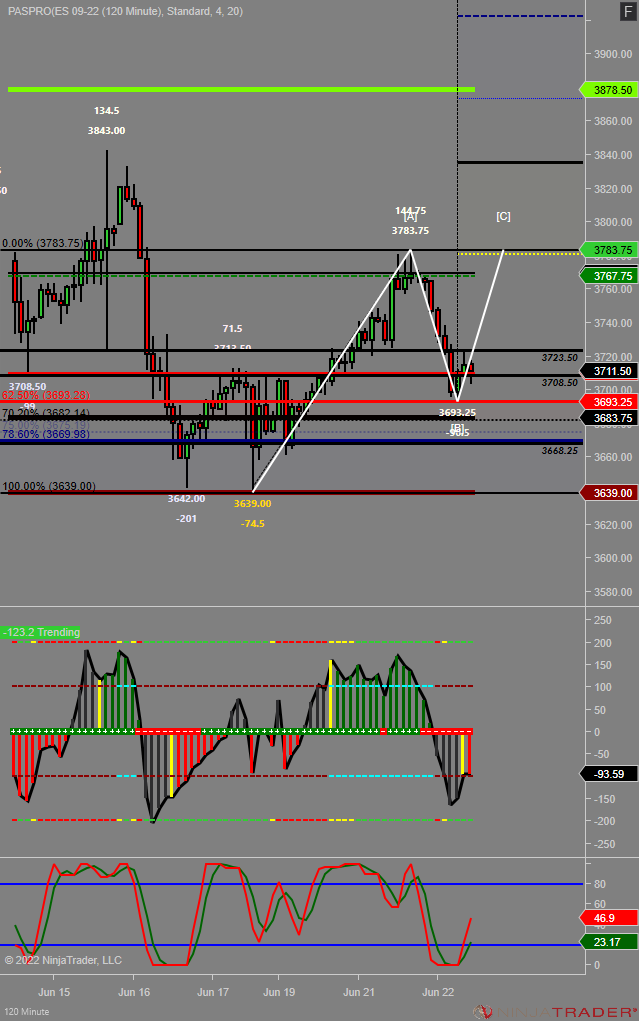

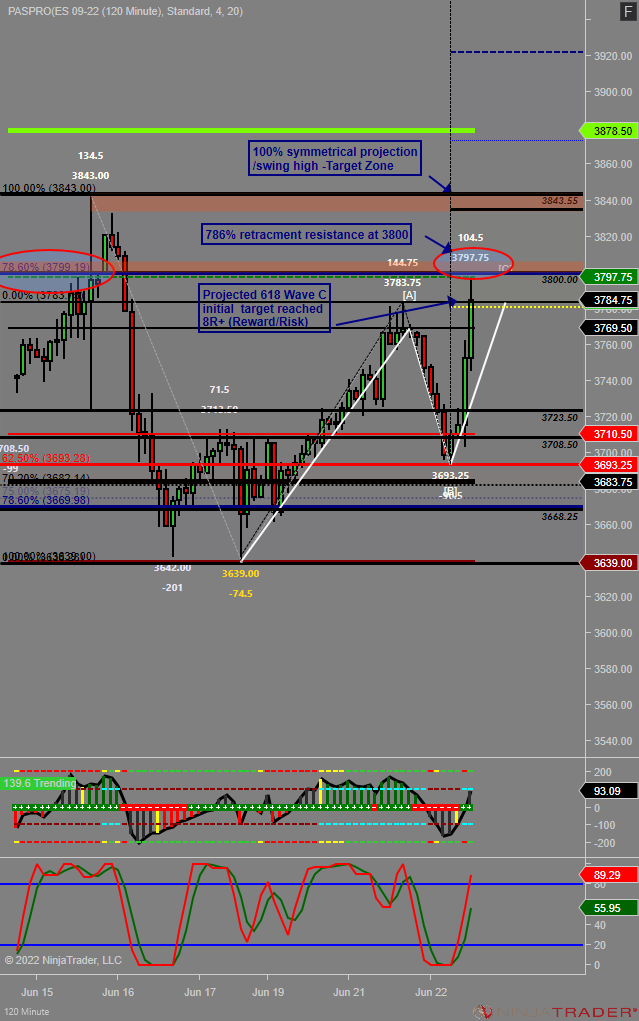

Markets tend to reverse within the 62.5%-78.6% retracement zone, this is a very high probability reversal zone where every trader must watch for possible reversal. Deep pullback zone reversal often happen in a wave2/B pullback after a possible trend reversal on higher time frame (daily in the current example).

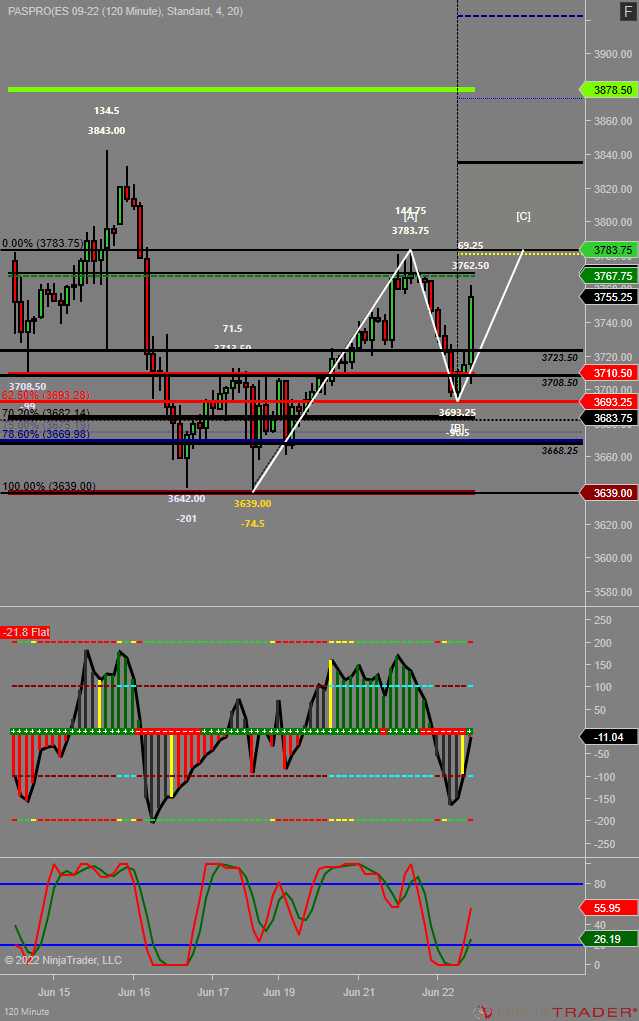

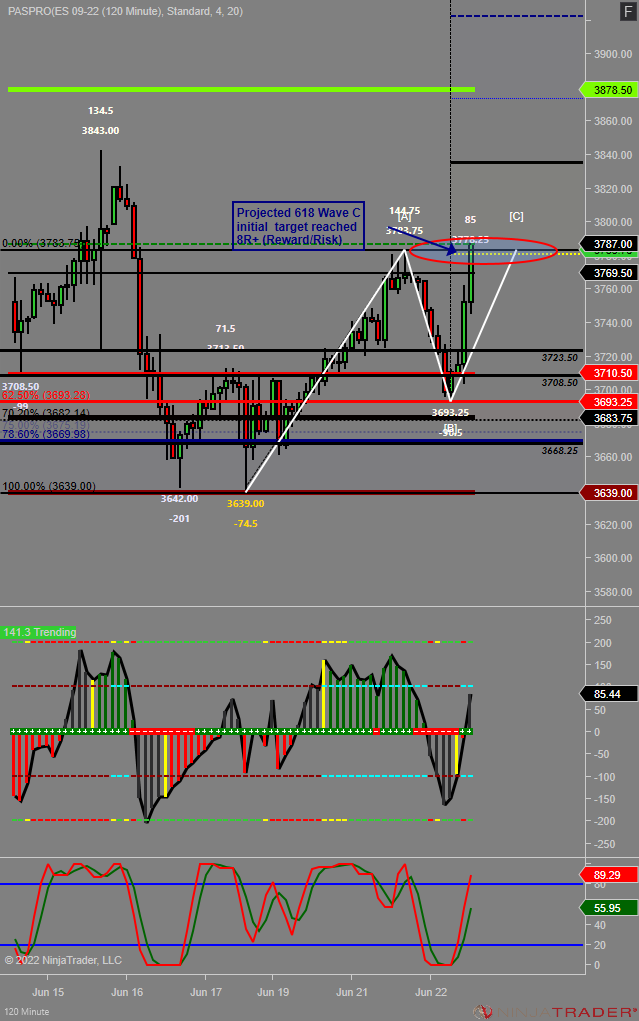

Projecting those ABC moves give a trader an edge for high probability setup with great Reward to Risk ratio.

I usually use 61.8% projection (with great success rate) as my initial target followed by 100% symmetrical move projected target.

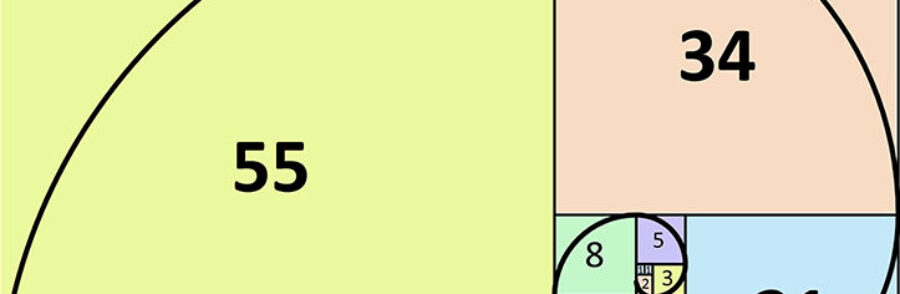

when it comes to trading, managing risk is crucial, using Fibonacci retracecment and projection gives you the edge to assess risk, and project a high probability outcome.

Obviously, not every trade works out perfectly like this one, but using this powerful tool can on different time frames can help traders to wait patiently for the high probability levels/zone, and using lower time frames/order-flow, momentum or volume tools to engage in the market for execution and risk management.

Hope you find this example useful.

Leave a Reply